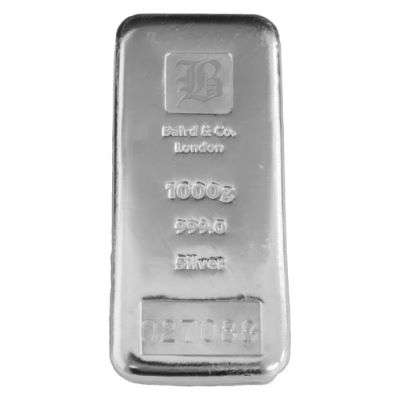

100 oz Baird & Co Silver Bullion Cast Bar

2.644,99 $

- Description

- Specifications

Description

Baird’s Wealth Management Division

Baird’s wealth management division offers a comprehensive range of services to help individuals and families achieve their financial goals. Their team of experienced advisors provide personalized advice and guidance on investment strategies, retirement planning, tax optimization, and estate planning. Whether clients are looking to grow their wealth, preserve their assets, or plan for the future, Baird’s wealth management experts are equipped with the knowledge and resources to help them navigate the complexities of the financial markets.

Baird’s Asset Management Division

In addition to wealth management, Baird’s asset management division offers a wide range of investment solutions for institutional and individual investors. Their team of investment professionals utilizes a disciplined and research-driven approach to identify attractive investment opportunities across various asset classes. From equity and fixed income strategies to alternative investments and multi-asset solutions, Baird’s asset management division provides clients with access to a diverse range of investment options tailored to their specific needs and risk tolerance.

Baird’s Investment Banking Division

When it comes to investment banking, Baird has a proven track record of helping companies raise capital, execute mergers and acquisitions, and navigate complex financial transactions. Their team of investment bankers works closely with clients to develop and execute strategic initiatives that drive growth and create value. With deep industry expertise and a global network of relationships, Baird’s investment banking division is well-positioned to assist clients in achieving their strategic objectives.

Baird’s Private Equity Division

Furthermore, Baird’s private equity division focuses on partnering with management teams to support the growth and development of middle-market companies. By providing capital, strategic guidance, and operational expertise, Baird’s private equity team helps businesses accelerate their growth and maximize their potential. With a long history of successful investments and a strong network of industry relationships, Baird’s private equity division has established itself as a trusted partner for companies seeking to unlock value and achieve sustainable growth.

Retirement Planning

Our team of experienced advisors at Baird’s wealth management division understands that financial planning is not a one-size-fits-all approach. We recognize that each client has different goals, risk tolerance, and time horizons, and we take the time to thoroughly assess these factors before developing a personalized strategy.

One of the key areas we specialize in is retirement planning. We understand that retirement can be an exciting yet challenging time, and our advisors are here to help you navigate through the complexities. We will work with you to determine how much you will need to save, develop a plan to maximize your savings, and create a diversified investment portfolio that aligns with your retirement goals.

Education Planning

In addition to retirement planning, we also offer expertise in education planning. We understand that saving for your child’s education can be a significant financial burden, and we are here to help you develop a plan that balances your long-term goals with your current financial situation. Our advisors can guide you through the various education savings options available, such as 529 plans and Coverdell Education Savings Accounts, and help you choose the best strategy for your family.

Major Life Events

Furthermore, we recognize that major life events can have a significant impact on your financial well-being. Whether you are getting married, starting a family, or going through a divorce, our wealth management team can provide the guidance and support you need during these transitions. We will help you assess the financial implications of these events and develop a plan to ensure your long-term financial stability.

Keeping You Informed

At Baird, we believe in the power of informed decision-making. That’s why our advisors are committed to keeping you updated on market trends, economic developments, and any other factors that may impact your investment portfolio. We provide regular portfolio reviews and performance reports, and our team is always available to answer any questions or concerns you may have.

Equity Strategies

Our equity strategies are designed to capitalize on opportunities in the stock market. Our experienced team of portfolio managers and analysts conduct in-depth research to identify companies with strong growth potential, solid fundamentals, and attractive valuations. We employ a bottom-up approach, focusing on individual stocks rather than broad market trends, to build portfolios that have the potential to outperform their benchmarks.

Fixed Income Strategies

For fixed income investors, we offer a range of strategies that aim to generate income while managing risk. Our fixed income team conducts rigorous credit analysis and utilizes a combination of top-down and bottom-up approaches to identify attractive investment opportunities in the bond market. We actively manage duration, credit quality, and sector allocations to navigate changing market conditions and deliver consistent returns.

Multi-Asset and Alternative Strategies

In addition to traditional asset classes, we also offer multi-asset and alternative strategies to provide diversification and potentially enhance risk-adjusted returns. Our multi-asset strategies combine different asset classes, such as stocks, bonds, and commodities, to create portfolios that can adapt to different market environments. Our alternative strategies, including hedge funds and private equity, offer access to non-traditional investments that have the potential to generate attractive returns and reduce portfolio volatility.

Investment Philosophy

At Baird, our investment philosophy is rooted in the belief that active management and disciplined research can lead to superior investment outcomes. We are committed to delivering personalized investment solutions that align with our clients’ goals and objectives. Whether you are an individual investor looking to grow your wealth, a financial advisor seeking institutional-quality solutions for your clients, or an institutional client in need of customized investment strategies, Baird’s asset management division has the expertise and resources to meet your needs.

Mergers and Acquisitions

One of the key areas of expertise within Baird’s investment banking division is mergers and acquisitions (M&A). Our team of professionals has a proven track record of successfully advising clients on M&A transactions across various industries.

When it comes to M&A, our approach is rooted in a thorough understanding of our clients’ businesses and their strategic objectives. We work closely with our clients to develop a comprehensive M&A strategy that aligns with their long-term goals. This involves conducting in-depth market research, analyzing industry trends, and identifying potential target companies or buyers.

Equity and Debt Offerings

In addition to M&A, Baird’s investment banking division also provides expertise in equity and debt offerings. Whether our clients are looking to raise capital through an initial public offering (IPO), a secondary offering, or a debt issuance, our team has the knowledge and experience to guide them through the process.

When it comes to equity offerings, we assist our clients in determining the optimal pricing and timing for their offerings. We also help them navigate the regulatory requirements and ensure compliance with securities laws. Our team has strong relationships with institutional investors and can help our clients attract the right investors for their offerings.

Similarly, when it comes to debt offerings, we work closely with our clients to structure the most advantageous financing solutions. This includes evaluating different debt instruments, negotiating terms with lenders, and ensuring that our clients have access to the capital they need to fund their growth initiatives.